Our guarantees

Maximum Refund Guarantee

Find an error that entitles you to a bigger refund? We'll refund your GOV+ fee and amend your return for free.

$10,000 Accuracy Guarantee

If our software makes a math error that causes IRS penalties or interest, we'll reimburse you — up to $10,000.

Audit Assistance

Get an audit letter? We'll provide informational guidance, FAQs, and IRS resources to help you respond.

Maximum Refund Guarantee: If you find an error in our tax preparation that entitles you to a larger refund or smaller liability, we'll refund your GOV+ fee and amend your return at no charge. Does not apply to differences in data you supplied, deductions you chose not to claim, positions contrary to law, or changes in tax law.

Accuracy Guarantee: If our software makes a mathematical error resulting in IRS penalties or interest you wouldn't otherwise owe, we'll reimburse you up to $10,000

Audit Assistance: If you receive an audit letter from the IRS or state authority for a return filed through GOV+, we'll provide informational assistance including FAQs and links to IRS resources. We do not represent you before tax authorities or provide legal advice.

We are not affiliated with the SSA. The SSA provides free forms and assistance.

File your taxes for $37. Stay for everything else.

Maximum refund guaranteed.

Then use GOV+ for passports, TSA PreCheck, and more — all year.

Trusted by millions. Featured in:

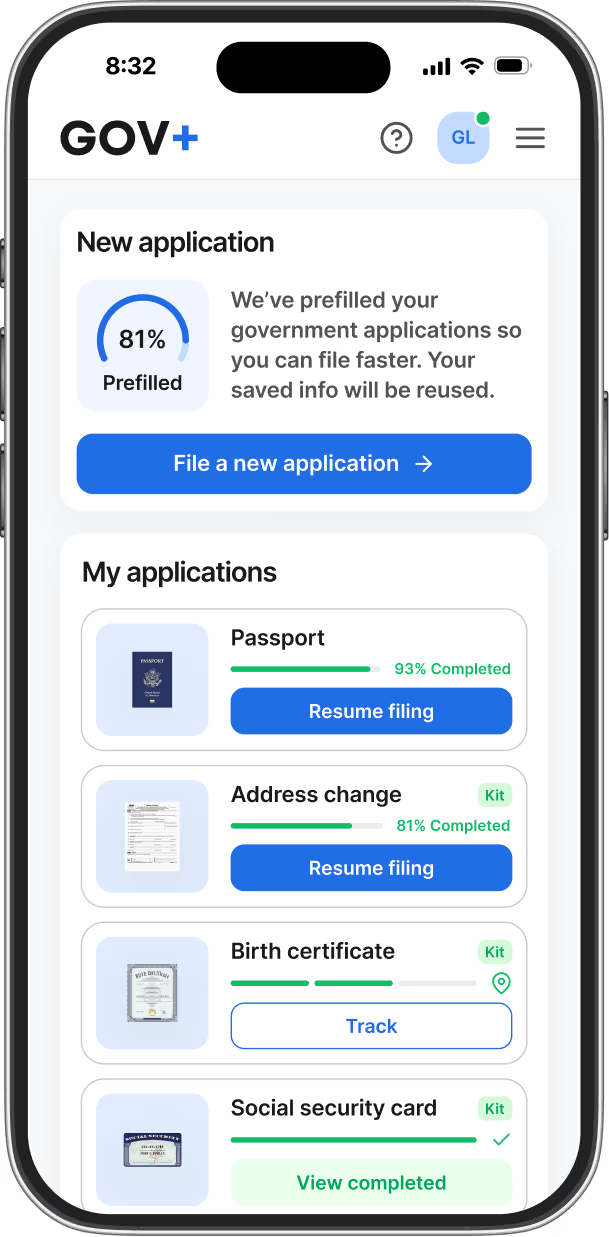

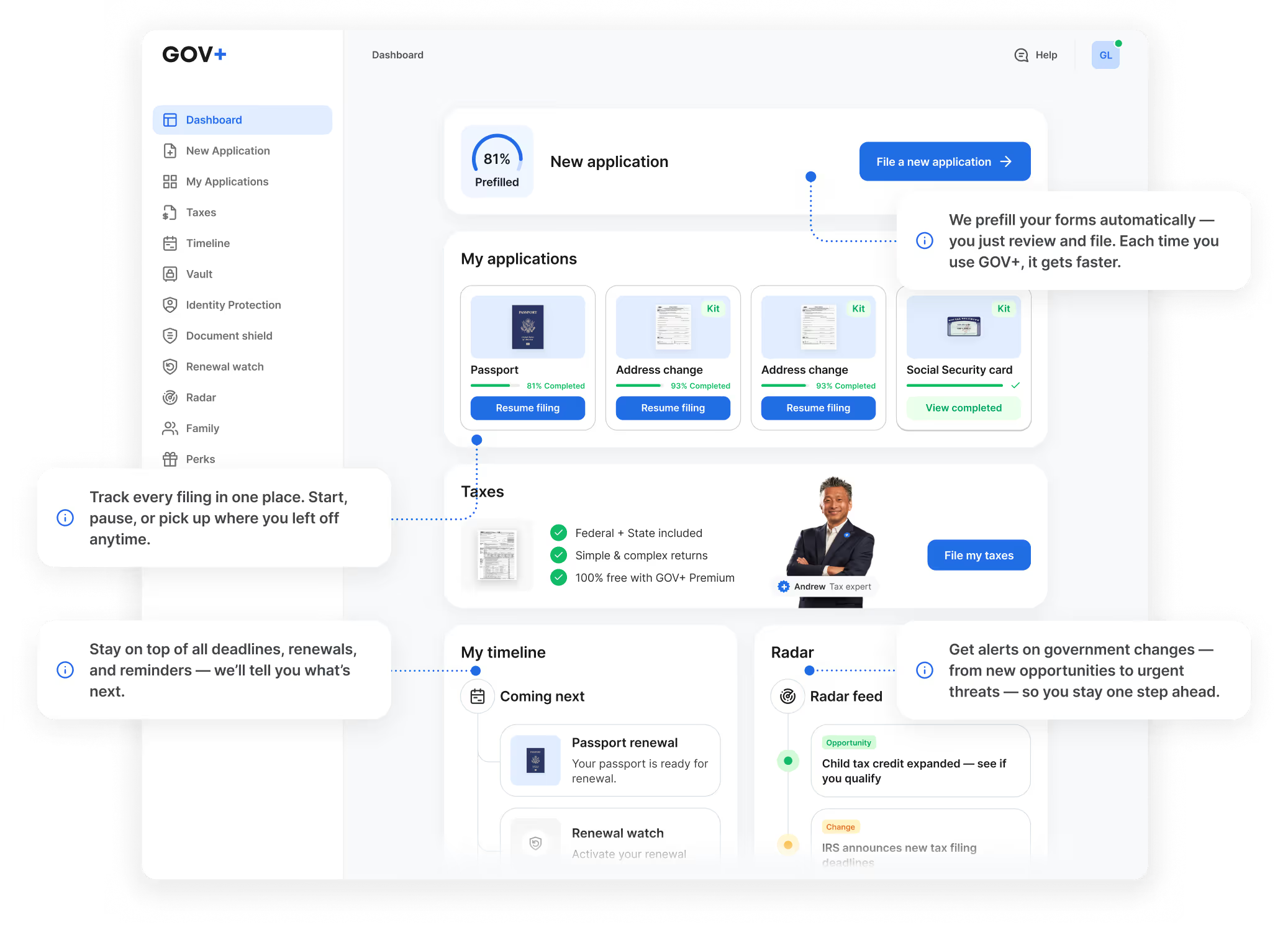

Not just April. All year.

Most tax apps collect dust after April 15. GOV+ is your autopilot for all government paperwork:

One profile, every form

Tax info auto-fills into passport, address changes, vital records requests, TSA PreCheck.

Tax fraud protection

24/7 SSN monitoring + $1M identity coverage

Tax law changes, delivered

Radar alerts you to new deductions and IRS updates

Save all your docs

W-2s, 1099s, past returns in your secure vault

Never miss a deadline

Timeline tracks tax dates, quarterly payments, refund status

Family dashboard

File for your whole family, track everyone's docs in one place

One low price. No surprises.

W2, 1099, freelance, self-employed — same price.

Individual Filers

Follow step-by-step, beginner-friendly guidance to get your maximum refund.

Homeowners & Families

Get every credit and deduction for families, homeowners, and earned income credit.

Investors & Property Owners

File returns for rental income, investments, or the sale of a home with confidence.

Freelancers & Small Businesses

Simplify taxes for gig workers, contractors, and small business owners.

How do we compare

Start return

Your best tax experience. Guaranteed.

Maximum refund guarantee

Find a bigger refund elsewhere? We'll refund 100% of your GOV+ fee and amend your return for free.

100% accuracy guarantee

If we make a math error that causes IRS penalties or interest, we'll pay them. Up to $10,000.

Audit assistance

Get an audit letter? We'll provide information guidance, FAQs, and IRS resources to help you respond.

We’ve got your back.

File my taxes

✓ JOIN 1M+ AMERICANS WHO USE GOV+

Maximum Refund with 100% Accuracy—Guaranteed.

We’re not the government — we’re a private company here to help.

Yes, it’s free to file yourself. But errors, delays, and wasted hours aren’t.

We are not affiliated with the SSA. The SSA provides free forms and assistance.

✓ JOIN 1M+ AMERICANS WHO USE GOV+

Maximum Refund with 100% Accuracy—Guaranteed.

We’re not the government — we’re a private company here to help. Yes, it’s free to file yourself. But errors, delays, and wasted hours aren’t.

We are not affiliated with the SSA. The SSA provides free forms and assistance.

File in as little as 10 minutes

Fill out a personalized form

GOV+ guides you through the process step by step to ensure accuracy and maximize deductions.

Upload your W2s in a snap

GOV+ uses your documents to autofill your tax forms and file your taxes for you automatically.

Get your maximum refund

Keep track of your tax refund until it’s deposited quickly and securely in your bank account.

GOV+ takes care of all the time-consuming steps, so you can get right back to your life.

Tax Filing 2025

Social Security name change

An accurate Social Security record is crucial for tax reporting, government benefits, and employment. GOV+ is here to simplify the process.

Passport name change

Your passport must match your current legal name. Let GOV+ handle the process, so that you can enjoy hassle-free international travel.

Postal office name change

Avoid any delivery confusion or delays. GOV+ will notify the USPS, so that your new name is reflected on your mail and packages.

Adult name change

If you’ve changed your name due to marriage, divorce, or personal reasons, GOV+ makes it easy to get all your official documents updated.

Veteran name change

GOV+ will notify the Department of Veterans of your new legal name so you can keep your veteran status compliant and access government services effectively.

Authorized by the official agencies that matter

Registered with the Department of State through Premier Passports LLC

Authorized E-file provider by the Internal Revenue Service (IRS)

Authorized API Access by Financial Crimes Enforcement Network (FinCEN) as a BOI provider

technology vendor

Approved technology vendor by the State of Florida

technology vendor

Approved technology vendor by the State of Puerto Rico

technology vendor

Approved technology vendor by the State of Washington

Making life easier for millions nationwide

"I am amazed at how simple this was. GOV+ walks you through everything you need!"

Thank you to Marion Garcia for being so accommodating.

“I thank GOV+ for the help, I was going to fly to Virginia on Friday to get my birth certificate. Now I can stay at home, thanks to all that tried to help me and I believe in GOV+."

“I just got off the phone with Alexander who went above and beyond to help me. He was polite and helpful. After we hung up and I thought we were finished, he called back to tell me I had submitted two applications. So appreciated!”

“Very helpful and professional in helping me with my my problem. I appreciate GOV+ on how the matter was completed.”

“The customer service team responded to my needs, questions and concerns expeditiously and professionally!

Thank you to Marion Garcia for being so accommodating.

“I thank GOV+ for the help, I was going to fly on Friday to get my birth certificate. Now I can stay at home, thanks to all that tried to help me and I believe in GOV+."

“I just got off the phone with Alexander who went above and beyond to help me. He was polite and helpful. After we hung up and I thought we were finished, he called back to tell me I had submitted two applications. So appreciated!”

“Very helpful and professional in helping me with my my problem. I appreciate GOV+ on how the matter was completed.”

“The customer service team responded to my needs, questions and concerns expeditiously and professionally!

Thank you to Marion Garcia for being so accommodating.

“I thank GOV+ for the help, I was going to fly to Virginia on Friday to get my birth certificate. Now I can stay at home, thanks to all that tried to help me and I believe in GOV+."

“I just got off the phone with Alexander who went above and beyond to help me. He was polite and helpful. After we hung up and I thought we were finished, he called back to tell me I had submitted two applications. So appreciated!”

“Very helpful and professional in helping me with my my problem. I appreciate GOV+ on how the matter was completed.”

“The customer service team responded to my needs, questions and concerns expeditiously and professionally!

Thank you for your help. Bert was very helpful. He is a valued employee.

“Karla handled everything for me. She was so nice!”

“I always get the best customer service and your agent was patient, knowledgeable. It's nice to talk to somebody who knows what they are talking about.”

“Thank you very much for making it so easy for me.”

“I am satisfied that things are settled. The help that I received from your supervisor was helpful and I am thankful.

Thank you for your help. Bert was very helpful. He is a valued employee.

“Karla handled everything for me. She was so nice!”

“I always get the best customer service and your agent was patient, knowledgeable. It's nice to talk to somebody who knows what they are talking about.”

“Thank you very much for making it so easy for me.”

“I am satisfied that things are settled. The help that I received from your supervisor was helpful and I am thankful.

Thank you for your help. Bert was very helpful. He is a valued employee.

“Karla handled everything for me. She was so nice!”

“I always get the best customer service and your agent was patient, knowledgeable. It's nice to talk to somebody who knows what they are talking about.”

“Thank you very much for making it so easy for me.”

“I am satisfied that things are settled. The help that I received from your supervisor was helpful and I am thankful.

File My Taxes

Never fill out another government application from scratch

Get it done right the first time, every time.

Experience laser-like accuracy and reliability with every application.

Up-to-date processes

Government processes are constantly changing. With GOV+, you can count on the most up-to-date information to get your application done right the first time.

Avoid common errors

Don’t let mistakes set you back months. With over one million successful applications completed, GOV+ provides laser-like accuracy to keep your documents on track.

24/7 support in seconds

No more spending hours on hold or going through painful phone menu prompts. Our friendly team of experts is standing by to get you on your way quickly.

What is income tax?

Income tax is a tax that is imposed on individuals and businesses based on their income or profits. It is a direct tax, meaning the taxpayer pays it directly to the government. The purpose of income tax is to fund government programs and services, such as education, healthcare, and infrastructure.

There are two main types of income tax: personal income tax and corporate income tax. Personal income tax is paid by individuals on their income, while businesses pay corporate income tax on their profits.

The first step in calculating your tax liability is determining taxable income. This is the amount of income that is subject to taxation. It includes all sources of income, such as wages, salaries, tips, interest, dividends, and capital gains.

If you need help with your tax filing, GOV+ can help you calculate and file taxes with 100% accuracy for a maximum refund guaranteed.

Reducing tax liabililties

One of the primary benefits of tax planning is reducing tax liabilities. By planning ahead and taking advantage of tax deductions and credits, individuals and businesses can significantly reduce the amount of taxes they owe. This can help them save money and avoid accumulating tax liabilities.

Maximizing tax refunds

Tax planning can also help individuals and businesses maximize their tax refunds. Individuals and companies can increase their chances of receiving a tax refund by taking advantage of all available deductions and credits. This can provide much-needed financial relief and help individuals and businesses achieve their financial goals.

Avoiding legal penalties

Proper tax planning can also help individuals and businesses avoid legal penalties. By staying up-to-date with tax laws and regulations, individuals and companies can ensure that they are paying the correct amount of taxes and avoid any legal consequences.

Funding government programs and services

Income tax is the primary source of revenue for the government. It funds various programs and services that benefit the public, such as education, healthcare, and infrastructure. Without income tax, the government would not have the necessary funds to provide these services.

Frequently asked tax questions

Do you pay taxes on Social Security benefits?

The short answer is yes, Social Security benefits can be taxable. However, not everyone will have to pay taxes on their benefits. The amount of taxes you owe on your benefits depends on your total income, including any other sources of income such as wages, interest, dividends, and retirement account distributions.

What is a tax write-off?

A tax write-off, also known as a tax deduction, is an expense that can be subtracted from your taxable income. This means that the amount of your taxable income is reduced, resulting in a lower tax bill. A tax write-off is a way to reduce the amount of taxes you owe to the government.

Do I need to file taxes if I am self-employed?

Yes, if you are self-employed, you must still file taxes. In fact, you may have additional tax obligations, such as paying self-employment taxes. Keeping accurate records of your income and expenses throughout the year is vital to simplify the tax filing process.

What is property tax?

Property tax is a tax on the value of a property, including land, buildings, and any improvements made to the property. It is an ad valorem tax, meaning it is based on the property's assessed value. Property tax aims to generate revenue for local governments to fund essential services and infrastructure.

What is capital gains tax?

Capital gains tax is a tax on the profit made from the sale of an asset. This can include stocks, bonds, real estate, and even collectibles. The tax only applies when the asset is sold for a profit, not when it is held or purchased.

The amount of capital gains tax you owe is determined by the difference between the asset's sale price and its original purchase price, also known as the cost basis. This is known as the capital gain.

What is a tax extension?

A tax extension is a request for additional time to file your tax return. It is important to note that a tax extension does not give you more time to pay any taxes owed. You are still required to estimate and pay your taxes by the original deadline, which is typically April 15th. A tax extension only gives you more time to file your return without incurring any late filing penalties.

What documents do I need to do my taxes?

Before you begin filing your taxes, gathering all the necessary documents is essential. This includes your W-2 forms from your employer, 1099 forms for any additional income, and any other relevant documents, such as receipts for charitable donations or business expenses. Having all your documents in one place will make the process much smoother.

How long will it take to receive my tax refund?

The method you use to file your taxes can significantly impact the timing of your refund. The IRS offers three options for filing: e-file, paper filing, and filing through a tax professional.

E-filing is the fastest and most efficient method of filing your taxes. When you e-file, your return is submitted electronically, and the IRS can process it much faster than a paper return. In fact, the IRS states that e-filed returns are typically processed within 21 days.

Paper filing, on the other hand, can take significantly longer. The IRS must manually enter the information from your paper return into their system, which can lead to delays. The IRS states that paper returns can take up to six weeks to process.

If you choose to file through a tax professional, the timing will depend on when they submit your return. If they e-file on your behalf, the same timeline of 21 days applies. However, if they file a paper return, it can take up to six weeks.

When are taxes due?

The due date for taxes varies depending on the type of tax and your location. Here are some general guidelines for when taxes are due:

- Income taxes: In the United States, income taxes are due on April 15th of each year. However, if April 15th falls on a weekend or holiday, the due date is pushed to the next business day. It's important to note that this due date only applies to federal income taxes.

- State income taxes may have different due dates, so checking with your state's tax agency for specific deadlines is essential.

.avif)