Our guarantees

Maximum Refund Guarantee

Find an error that entitles you to a bigger refund? We'll refund your GOV+ fee and amend your return for free.

$10,000 Accuracy Guarantee

If our software makes a math error that causes IRS penalties or interest, we'll reimburse you — up to $10,000.

Audit Assistance

Get an audit letter? We'll provide informational guidance, FAQs, and IRS resources to help you respond.

Maximum Refund Guarantee: If you find an error in our tax preparation that entitles you to a larger refund or smaller liability, we'll refund your GOV+ fee and amend your return at no charge. Does not apply to differences in data you supplied, deductions you chose not to claim, positions contrary to law, or changes in tax law.

Accuracy Guarantee: If our software makes a mathematical error resulting in IRS penalties or interest you wouldn't otherwise owe, we'll reimburse you up to $10,000

Audit Assistance: If you receive an audit letter from the IRS or state authority for a return filed through GOV+, we'll provide informational assistance including FAQs and links to IRS resources. We do not represent you before tax authorities or provide legal advice.

We are not affiliated with the SSA. The SSA provides free forms and assistance.

File your taxes for $37. Stay for everything else.

Maximum refund guaranteed.

Then use GOV+ for passports, TSA PreCheck, and more — all year.

Trusted by millions. Featured in:

One low price. No surprises.

W2, 1099, freelance, self-employed — same price.

Individual Filers

Follow step-by-step, beginner-friendly guidance to get your maximum refund.

Homeowners & Families

Get every credit and deduction for families, homeowners, and earned income credit.

Investors & Property Owners

File returns for rental income, investments, or the sale of a home with confidence.

Freelancers & Small Businesses

Simplify taxes for gig workers, contractors, and small business owners.

How do we compare

Start return

Your best tax experience. Guaranteed.

Maximum refund guarantee

Find a bigger refund elsewhere? We'll refund 100% of your GOV+ fee and amend your return for free.

100% accuracy guarantee

If we make a math error that causes IRS penalties or interest, we'll pay them. Up to $10,000.

Audit assistance

Get an audit letter? We'll provide information guidance, FAQs, and IRS resources to help you respond.

We’ve got your back.

File my taxes

✓ JOIN 1M+ AMERICANS WHO USE GOV+

With GOV+, you can complete your TSA PreCheck® application in just minutes.

We’re not the government — we’re a private company here to help.

Yes, it’s free to file yourself. But errors, delays, and wasted hours aren’t.

We are not affiliated with the SSA. The SSA provides free forms and assistance.

✓ JOIN 1M+ AMERICANS WHO USE GOV+

With GOV+, you can complete your TSA PreCheck® application in just minutes.

We’re not the government — we’re a private company here to help. Yes, it’s free to file yourself. But errors, delays, and wasted hours aren’t.

We are not affiliated with the SSA. The SSA provides free forms and assistance.

TSA PreCheck process made easy

You fill out a personalized TSA PreCheck form

GOV+ completes your application documents for you, so you don’t have to worry about mistakes and delays.

GOV+ books your appointment with TSA

We find the closest TSA facility and book the quickest appointment available for you.

You get your PreCheck® approval by email

After your interview, receive your results by email in a few days.

GOV+ takes care of all the time-consuming steps, so you can get right back to your life.

New TSA PreCheck®

Skip long lines at the airport by submitting your first-time TSA PreCheck® application with GOV+.

TSA PreCheck® renewal

Your TSA PreCheck® application needs to be renewed every 5 years. GOV+ makes the process easier than ever.

Social Security name change

An accurate Social Security record is crucial for tax reporting, government benefits, and employment. GOV+ is here to simplify the process.

Passport name change

Your passport must match your current legal name. Let GOV+ handle the process, so that you can enjoy hassle-free international travel.

Postal office name change

Avoid any delivery confusion or delays. GOV+ will notify the USPS, so that your new name is reflected on your mail and packages.

Adult name change

If you’ve changed your name due to marriage, divorce, or personal reasons, GOV+ makes it easy to get all your official documents updated.

Veteran name change

GOV+ will notify the Department of Veterans of your new legal name so you can keep your veteran status compliant and access government services effectively.

Authorized by the official agencies that matter

Registered with the Department of State through Premier Passports LLC

Authorized E-file provider by the Internal Revenue Service (IRS)

Authorized API Access by Financial Crimes Enforcement Network (FinCEN) as a BOI provider

technology vendor

Approved technology vendor by the State of Florida

technology vendor

Approved technology vendor by the State of Puerto Rico

technology vendor

Approved technology vendor by the State of Washington

Making life easier for millions nationwide

"I am amazed at how simple this was. GOV+ walks you through everything you need!"

Thank you to Marion Garcia for being so accommodating.

“I thank GOV+ for the help, I was going to fly to Virginia on Friday to get my birth certificate. Now I can stay at home, thanks to all that tried to help me and I believe in GOV+."

“I just got off the phone with Alexander who went above and beyond to help me. He was polite and helpful. After we hung up and I thought we were finished, he called back to tell me I had submitted two applications. So appreciated!”

“Very helpful and professional in helping me with my my problem. I appreciate GOV+ on how the matter was completed.”

“The customer service team responded to my needs, questions and concerns expeditiously and professionally!

Thank you to Marion Garcia for being so accommodating.

“I thank GOV+ for the help, I was going to fly on Friday to get my birth certificate. Now I can stay at home, thanks to all that tried to help me and I believe in GOV+."

“I just got off the phone with Alexander who went above and beyond to help me. He was polite and helpful. After we hung up and I thought we were finished, he called back to tell me I had submitted two applications. So appreciated!”

“Very helpful and professional in helping me with my my problem. I appreciate GOV+ on how the matter was completed.”

“The customer service team responded to my needs, questions and concerns expeditiously and professionally!

Thank you to Marion Garcia for being so accommodating.

“I thank GOV+ for the help, I was going to fly to Virginia on Friday to get my birth certificate. Now I can stay at home, thanks to all that tried to help me and I believe in GOV+."

“I just got off the phone with Alexander who went above and beyond to help me. He was polite and helpful. After we hung up and I thought we were finished, he called back to tell me I had submitted two applications. So appreciated!”

“Very helpful and professional in helping me with my my problem. I appreciate GOV+ on how the matter was completed.”

“The customer service team responded to my needs, questions and concerns expeditiously and professionally!

Thank you for your help. Bert was very helpful. He is a valued employee.

“Karla handled everything for me. She was so nice!”

“I always get the best customer service and your agent was patient, knowledgeable. It's nice to talk to somebody who knows what they are talking about.”

“Thank you very much for making it so easy for me.”

“I am satisfied that things are settled. The help that I received from your supervisor was helpful and I am thankful.

Thank you for your help. Bert was very helpful. He is a valued employee.

“Karla handled everything for me. She was so nice!”

“I always get the best customer service and your agent was patient, knowledgeable. It's nice to talk to somebody who knows what they are talking about.”

“Thank you very much for making it so easy for me.”

“I am satisfied that things are settled. The help that I received from your supervisor was helpful and I am thankful.

Thank you for your help. Bert was very helpful. He is a valued employee.

“Karla handled everything for me. She was so nice!”

“I always get the best customer service and your agent was patient, knowledgeable. It's nice to talk to somebody who knows what they are talking about.”

“Thank you very much for making it so easy for me.”

“I am satisfied that things are settled. The help that I received from your supervisor was helpful and I am thankful.

File My Taxes

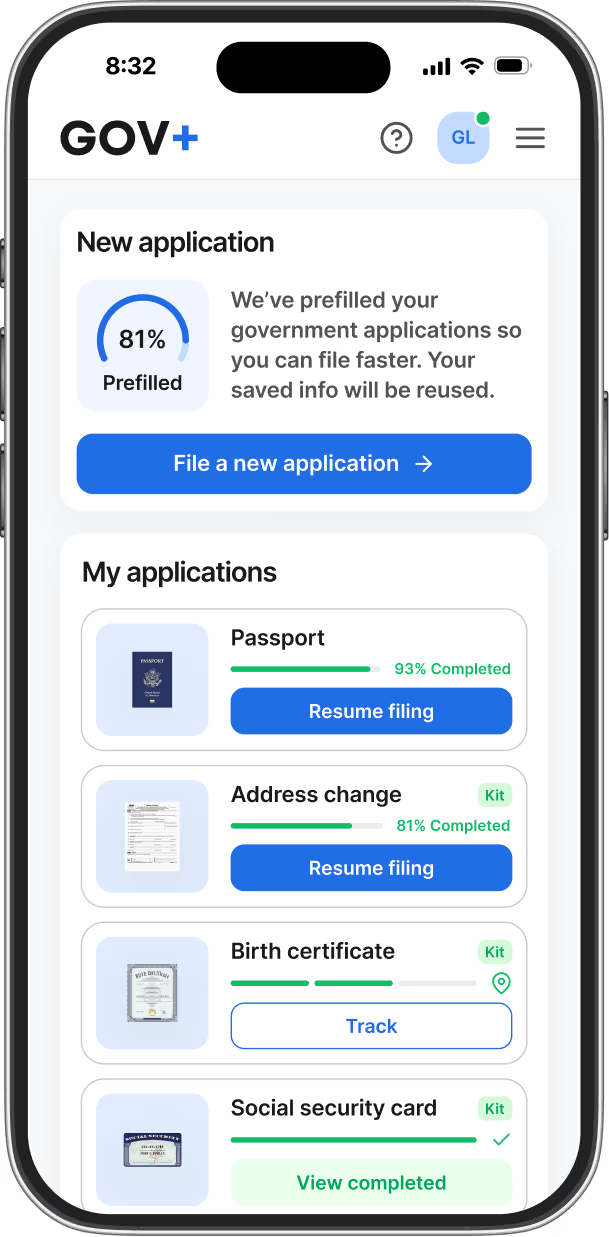

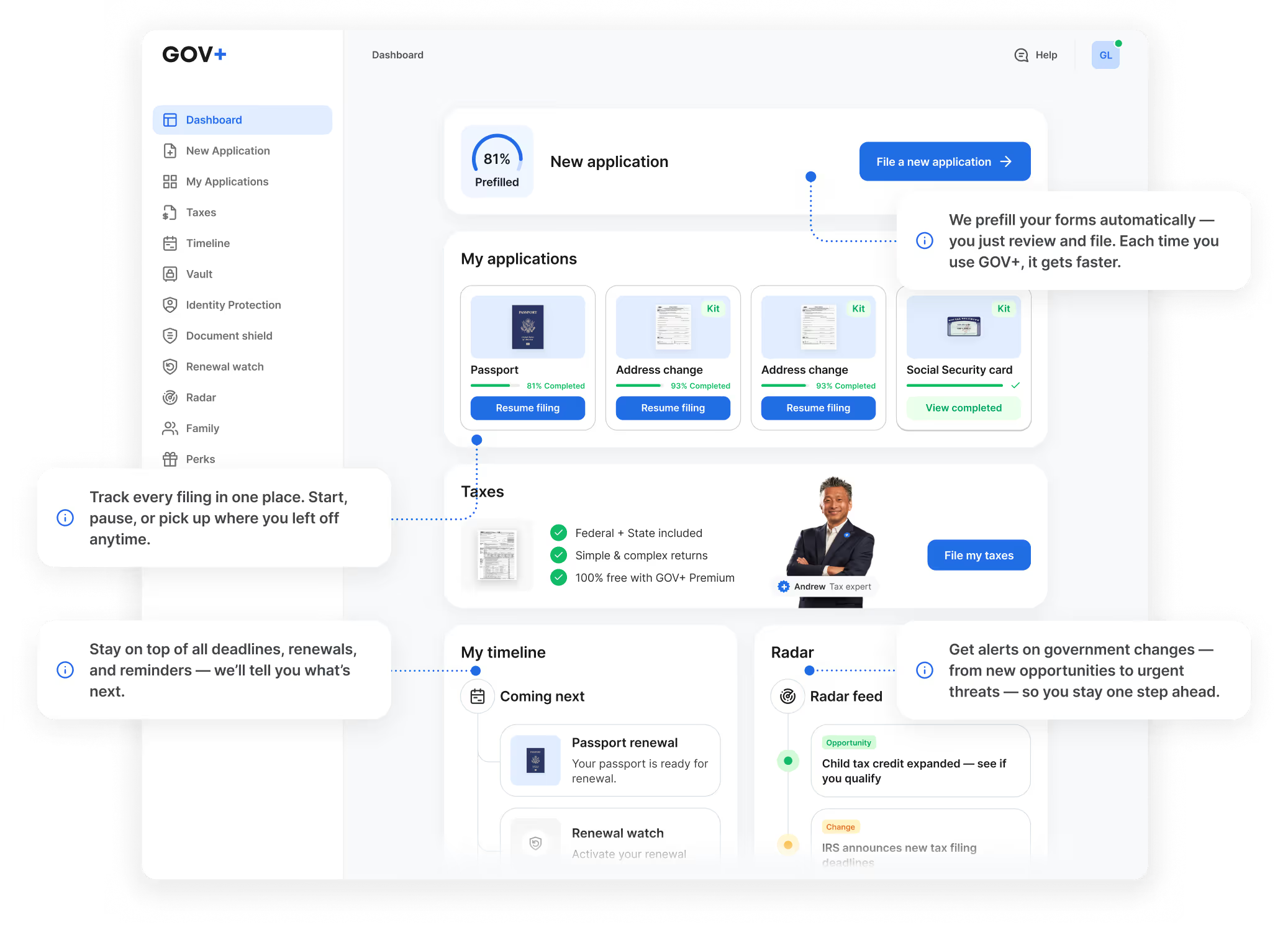

Never fill out another government application from scratch

Get it done right the first time, every time.

Experience laser-like accuracy and reliability with every application.

Up-to-date processes

Government processes are constantly changing. With GOV+, you can count on the most up-to-date information to get your application done right the first time.

Avoid common errors

Don’t let mistakes set you back months. With over one million successful applications completed, GOV+ provides laser-like accuracy to keep your documents on track.

24/7 support in seconds

No more spending hours on hold or going through painful phone menu prompts. Our friendly team of experts is standing by to get you on your way quickly.

What is TSA PreCheck?

TSA PreCheck® is part of the U.S. Transportation Security Administration’s “Trusted Traveler” program. It enables eligible, low-risk travelers to undergo expedited screening at the TSA security checkpoint for domestic and international air travel. More than 200 airports and 80 airlines allow qualified travelers to enter a special TSA PreCheck line.

On average, it takes TSA PreCheck passengers less than 5 minutes to pass through airport security.

Shorter lines at airport

For anyone who frequently flies, the TSA PreCheck program can be a lifesaver. TSA PreCheck allows low-risk flyers to go through a shorter and faster security line at the airport. For anyone who values their time and schedule.

Expedited security check

Anyone who has flown knows the drill: take off your shoes, put your passport and boarding pass on the tray, empty your pockets. It's a hassle, especially when you're in a hurry. TSA PreCheck allows you to keep your shoes and light jacket on, and keep your laptop in its case.

Frequently asked TSA PreCheck questions

How to Apply for TSA PreCheck®

With GOV+ you can complete your TSA PreCheck® application in under five minutes. Simply follow these steps:

- Check eligibility – Confirm that you’re an eligible applicant with no disqualifying factors.

- Apply for TSA PreCheck with GOV+ – Submitting your application form through GOV+ simplifies the entire process.

- We schedule an appointment for you – There are more than 380 appointment centers where you can complete the requisite 20-minute background check and fingerprinting process.

- Pay applicable fees – For most travelers, there is an $78 application fee. Certain credit card programs and promotions will pay this on your behalf.

.avif)