How to change your address with the IRS

During the excitement of a big move, it can be easy to forget about the little details (that’s where our handy change of address checklist comes in!). For instance, ensuring that the IRS has your correct address on file is likely one of the last things on your mind.

However, whether you’re moving down the street or across the country, you need to change your address with the IRS. This can be crucial for receiving government checks, getting your income tax return, and getting important documents sent to the right mailing address. While dealing with the red tape of government agencies can seem daunting, it doesn’t need to be—that’s why we’re here to help. To that end, if you want to know how to change your address with the IRS or “how much does it cost to change your address,” you’ve come to the right place.

Why should I keep my address up to date?

Before we dive into the process of changing your address, it’s important to understand why doing so is important. In which case, here are a few reasons why you should keep the IRS up to date on your home address:

- To receive a tax refund – If you’re one of the three-quarters of Americans who receive a tax refund each year, you’ll want to want to make sure that money ends up in your hands. The IRS needs an accurate address to send you your refund check.

- To receive time-sensitive communication from the IRS – Because it’s your responsibility to change your address, the IRS assumes that the address they have on file is correct. If they send important, time-sensitive mail—such as an audit or notice of an outstanding balance—to your old address, you still have to respond to it within the originally stated time period. Having an old address on file could mean a late response to the IRS, which is never ideal. It is important and critical that the IRS has your updated address for IRS correspondence alone to avoid fees or something worse.

What you’ll need for a change of address

There are several ways to change your old address to your updated address with the IRS. But regardless of how you make the change, you’ll need specific information to ensure it’s a smooth process. We recommend preparing all of the details below before you initiate a change of address.

Your new address

This may seem obvious, but you’ll need to know your new address in full before you notify the IRS of the change. Triple check that you haven’t made any mistakes writing the new address down, as sometimes our brains will instinctively write our old address!

Your old address

You will also need to provide your old address, so don’t erase it from your memory until you’ve completed your change of address.

Your personal information

The IRS will ask you for the same basic details on almost every form. These include:

- Your full name

- Any prior names (if applicable)

- Your date of birth

- Your Social Security number (SSN)

Chances are you have all of this info memorized, but it’s still nice to know exactly what is expected of you before you start the process.

Your spouse’s personal information (If applicable)

If you’re not married or separated, you can skip this section. For those of you that do file joint taxes, you will need the following:

- Your spouse’s full name

- Any of their prior names (if applicable)

- Their Social Security number

- Their old address (if applicable)

Note that your former address may differ from your spouse’s—for example, if you are moving in together for the first time. The IRS anticipates this and includes space for two previous addresses on their forms.

How to change your address with the IRS

So how do you change your address with the IRS? For your convenience, the agency offers multiple ways for you to notify them of an address change.

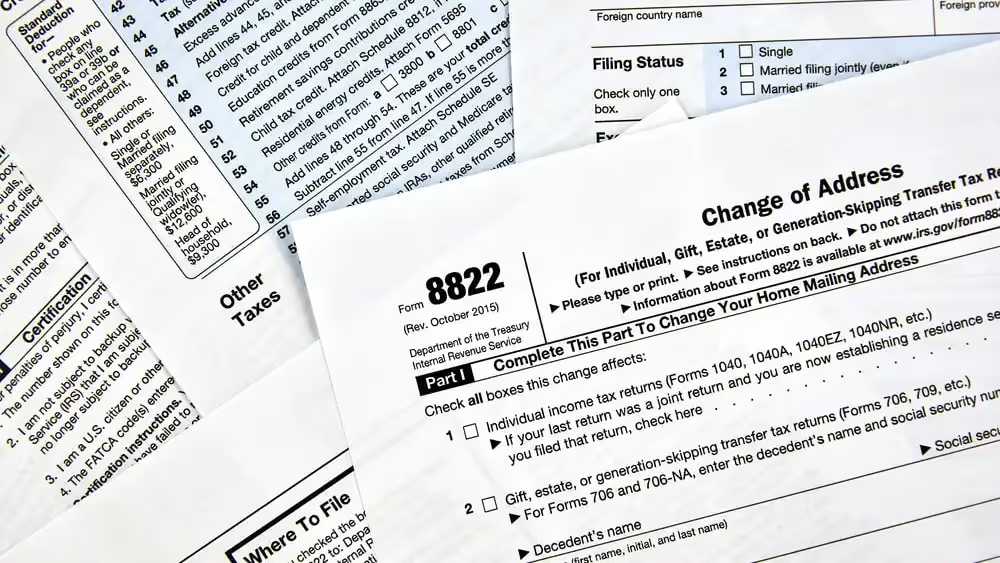

Using form 8822

The 8822 form is a single-page IRS form that asks for all of the information listed above, alongside a signature and an optional contact number. Be careful not to confuse the 8822 IRS form with the 8822-B form, which is required for a business address change. Should you be self-employed and working from home, you will also need to fill out the 8822-B.

Lastly, always confirm you’re using the official, up-to-date forms from the IRS website.

Many people wonder “Can I change my address online with the IRS?”. The quick answer is no, but there are a couple of ways you can start a changed address request which includes by phone, in person, or via tax return.

By phone

Individuals can call 1-800-829-1040 between 7 a.m. and 7 p.m. local time to update their address. For security purposes, you may be asked for additional information to verify your identity.

In person

If you’d like, you can make an appointment to visit your local IRS office.

Via tax return

You can update your address when you file your annual tax return by using your new address. With that said, unless your move is relatively close to tax season, it’s best to notify the IRS sooner.

Using us to change your address

We understand that tasks like this can be time-consuming, frustrating, and confusing. To top it off, moving your entire household is enough work without factoring in the paperwork you’ll need to send to the IRS.

That’s why we’re here to take care of the process. If you want to ensure that your change of address is filed accurately, promptly, and swiftly, then you’re in the right place. Using our innovative, cloud-based technology, all you need to fill out one form, and we take care of the rest. Experts in all things government, we’ve streamlined the process by combining a stellar customer service team with patented technology. Simplify the process and apply for a change of address online with GOV+.

That’s one less thing to worry about.

Sources:

- Yahoo! Finance. Tax Refunds in America and Their Hidden Cost – 2020 Edition. https://ca.finance.yahoo.com/news/tax-refunds-america-hidden-cost-120048320.html

IRS. - Methods to Change Your Address. https://www.irs.gov/faqs/irs-procedures/address-changes/address-changes